Who needs California Homestead Declaration?

A Homestead Declaration is a document that entitles homeowners in the State of California with a protection of a certain amount of equity in their home from creditors. It is a helpful document in terms that is written statement in which a homeowner claims the certain residential property as their principal place of residence. When the declaration is prepared (and recorded properly), it immunizes the dwelling and the premises from some legal enforcement measures. The most widespread cases can include a bankruptcy: even though the owner has filed a bankruptcy petition, it may be possible to keep the home or a portion of the equity in the property as opposed to losing it to creditors.

Is the Homestead Declaration accompanied by other forms?

On its completing, there is no need to support the declaration with any other forms or statements. Yet, so far as it has to be notarized, the applicant should not forget to pay the appropriate fees for notarization and decoration of the declaration.

When is California Homestead Declaration due?

The completion of the Declaration Form does not imply following a certain deadline or time limitations, nor it has an expiration date. Besides, if the homeowner moves this ? The form can be filled out when considered necessary. Besides, if the homeowner moves to a different dwelling (without selling the declared property) the declaration still remains valid.

What information should be provided in the Homestead Declaration?

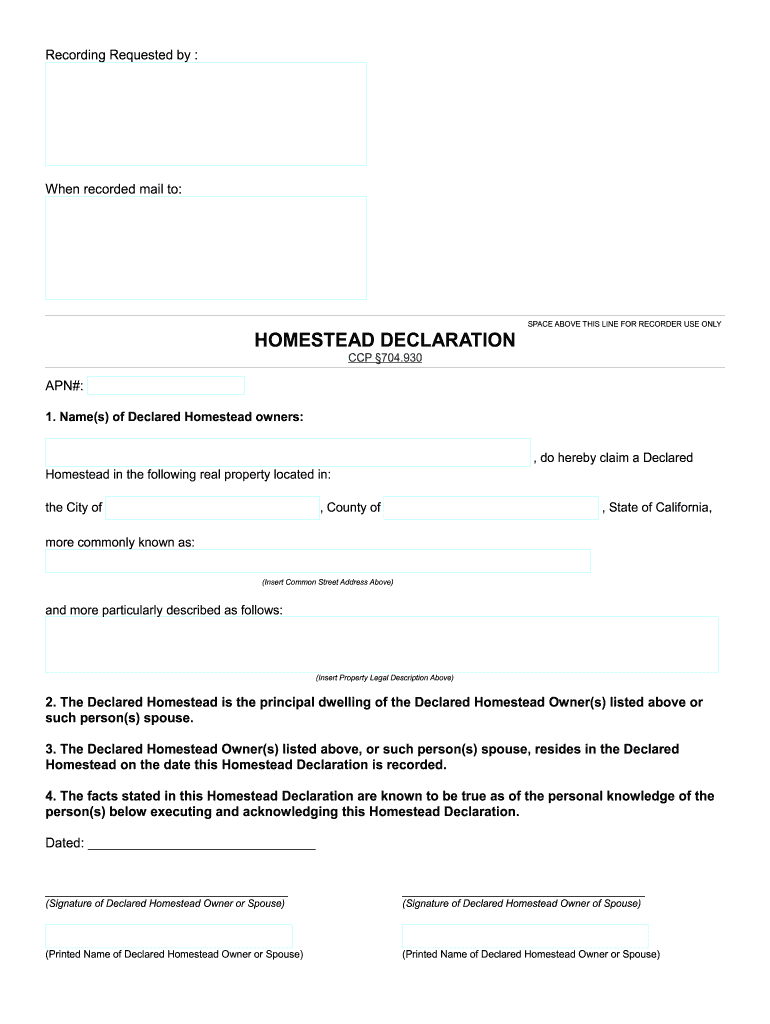

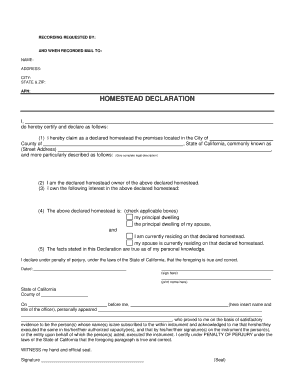

The completed first page of the declaration should provide the following information:

- APN number;

- Name(s) of the homestead owner(s);

- Address of the declared property;

- Property legal description;

- Date;

- Signature.

The second page is allotted for the certification of the declaration by a notary public.

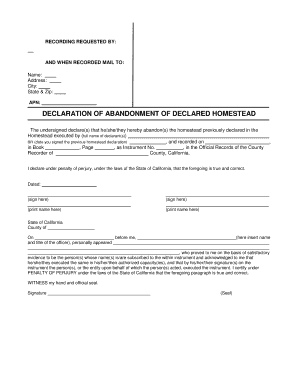

Where do I send the Homestead Declaration?

The Declaration when completed by the homestead owner(s) and authorized by a notary, must be directed to the County Recorder’s Office for decoration.